DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

Investing 20 Billion JPY in the Fields of Blockchain, AI, VR/AR, Security, and BioHealth

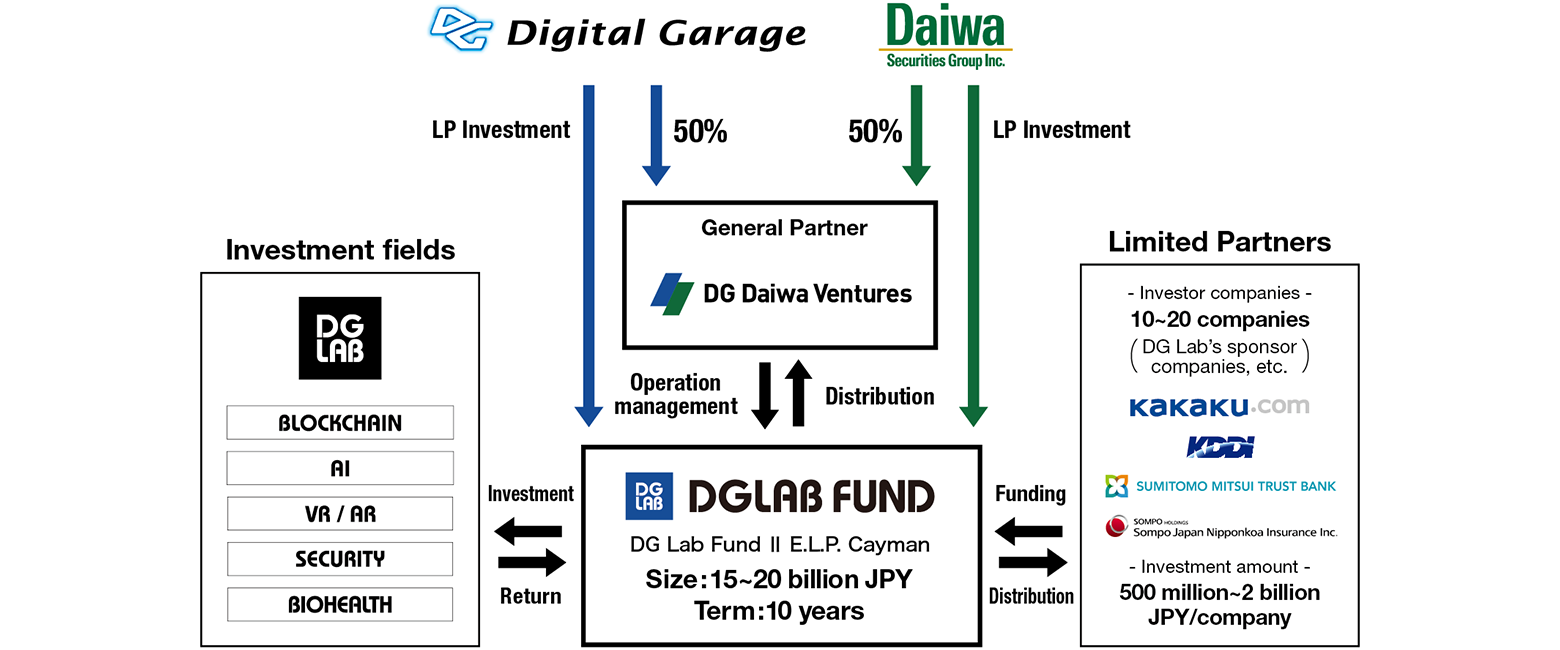

DG Daiwa Ventures Inc. (HQ: Tokyo; Representative Directors: Masahito Okuma and Akihiko Ogino; DG Daiwa Ventures), a joint venture between Digital Garage, Inc. (TSE first section: 4819; HQ: Tokyo; Representative Director, President Executive Officer and Group CEO: Kaoru Hayashi; DG) and Daiwa Securities Group Inc. (TSE first section: 8601; HQ: Tokyo; President & CEO: Seiji Nakata; Daiwa Securities Group), has established DG Lab Fund II E.L.P. Cayman (In short, DG Lab Fund II), an investment fund for global startups with next-generation technologies.

DG Lab Fund II will work with DG Lab –an open innovation R&D organization– to invest in promising Japanese and foreign startups in DG Lab’s five R&D fields: Blockchain, AI, VR/AR, Security, and BioHealth, just like DG Lab Fund I. With participation from industry-leading companies in various fields and in collaboration with DG Lab, DG Lab Fund II will precisely understand the diversifying startup circumstances and cutting-edge technological trends to rigorously select and invest in excellent startups in each field.

DG will contribute to DG Lab Fund II building a superior portfolio through DG’s network of strategic partner companies and prominent investors, as well as the activities in DG Lab. The operation of DG Lab Fund II will also incorporate the extensive expertise developed by the Daiwa Securities Group as an integrated securities group. The first round has closed as of August 2019 with a total amount of over 10 billion JPY, with participating companies including existing core partners of DG Lab such as Kakaku.com, Inc. and KDDI CORPORATION, newly joined companies Sumitomo Mitsui Trust Bank, Limited, Sompo Japan Nipponkoa Insurance Inc. and more. The final close is planned in March 2020, with the final fund amount of around 20 billion JPY. This means DG Daiwa Ventures will operate funds totaling around 30 billion JPY (DG Lab Funds I and II).

DG Lab Fund is achieving multiple accomplishments thanks to its incubation function in collaboration with DG Lab, of which engineers have exemplary technical competence. For example, Crypto Garage, Inc. (HQ: Tokyo; President: Masahito Okuma) was founded for blockchain financial service development as a joint venture by DG, investee Blockstream (HQ: Canada; CEO: Adam Back), and investor The Tokyo Tanshi Co., Ltd. (HQ: Tokyo; President: Shoji Ushiro; Tokyo Tanshi). Crypto Garage received the first official authorization in the finance field under the Regulatory Sandbox, managed by the Cabinet Office of Japan, in January 2019. Under this Regulatory Sandbox system, Crypto Garage and multiple business partners have started proof-of-concept testing the issuance of Japanese JPY tokens and the delivery versus payment settlement service between tokens and crypto assets. In the future, we will accelerate business promotion and open innovation development of investees through collaboration with: the DG Lab’s development assets in the blockchain field, the general-purpose framework “DG Lab DVEP (Digital Value Exchange Platform) ™” that can issue proprietary cryptocurrencies on the bitcoin-based blockchain; in the next-generation data technology researches in AI field; and the “Open Network Lab” accelerator program both in the smart city incubation and the biohealth field.

To achieve the biggest ROI, choices and investments can be made in excellent startups from a global perspective, as investees are selected from the profusion of international deal sources retained by the DG group including its Global Incubation Stream connecting North America, Japan, Asia, and Europe. In operating the fund, the Daiwa Securities Group applies its experience and know-how to make the most of these advantages. DG Lab Fund will continue to push forward the development as a venture investment fund with a new structure, utilizing the investment network and incubation competence of the DG Group and the fund management expertise of the Daiwa Securities Group.

【DG Daiwa Ventures】

https://dg-daiwa-v.com/en/

DG Daiwa Ventures is a venture capital firm jointly founded by DG and the Daiwa Securities Group to invest in startups with next-generation technologies and assist their business development. DG Lab Fund accelerates investees’ growth by combining the investment network and incubation competence of the DG Group and the fund management expertise of the Daiwa Securities Group in five technical fields: Blockchain, AI, VR/AR, Security, and BioHealth.

【DG Lab】

https://www.dglab.com/en/

An open innovation R&D organization jointly operated by DG, Kakaku.com, Inc. (TSE first section: 2371; HQ: Tokyo; President and Representative Director: Shonosuke Hata), Credit Saison Co., Ltd. (TSE first section: 8253; HQ: Tokyo; Chairman and CEO: Hiroshi Rinno) and KDDI CORPORATION (TSE first section: 9433; HQ: Tokyo; President, Representative Director: Makoto Takahashi). Daiwa Securities Group Inc.; TIS Inc.; and Resona Bank, Limited. are sponsoring partners.

*This press release is not intended to offer any investment operation services and specific operation products by DG, Daiwa Securities Group and DG Daiwa Ventures. DG, Daiwa Securities Group and DG Daiwa Ventures are not calling for any participation of DG Lab Funds I and II through this press release.